Corporate Tax Rate 2019 Malaysia

Kpmg s corporate tax table provides a view of corporate tax rates around the world.

Corporate tax rate 2019 malaysia. A company whether resident or not is assessable on income accrued in or derived from malaysia. How to pay income. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

How does monthly tax deduction mtd pcb work in malaysia. The current cit rates are provided in the following table. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices.

Corporate tax rate will be reduced to 17 from 18 for smes with paid capital below rm2 5m and businesses with annual taxable income below rm500 000. Resident companies are taxed at the rate of 24. Resident company other than company.

Tax rates are checked regularly by kpmg member firms. However please confirm tax rates with the country s tax authority before using them to make business decisions. Malaysia corporate taxes on corporate income last reviewed 01 july 2020.

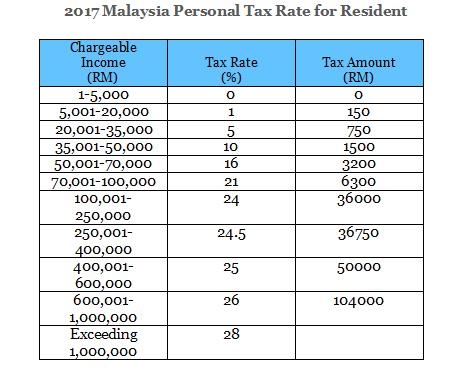

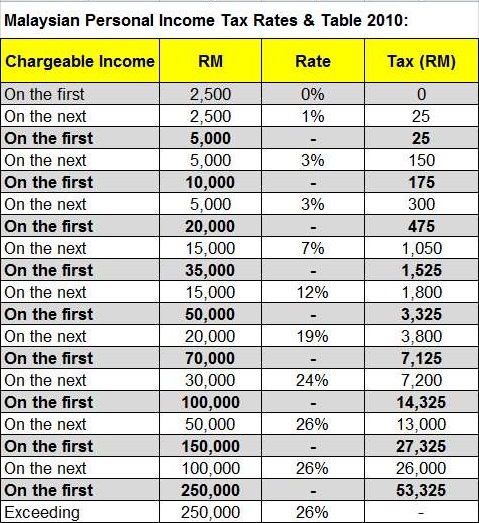

Chargeable income myr cit rate for year of assessment 2019 2020. What is income tax return. These proposals will not become law until their enactment and may be amended in the course of their passage through.

For small and medium enterprise sme the first rm500 000 chargeable income will be tax at 17 with effective from ya 2019 and the chargeable income above rm500 000 will be tax at 24. Income derived from sources outside malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business and sea and air transport undertakings. Use our interactive tax rates tool to compare tax rates by country jurisdiction or region.

Corporate tax rate in malaysia is expected to reach 24 00 percent by the end of 2020 according to trading economics global macro models and analysts expectations. 21 21 malaysian tax booklet income tax. Malaysia adopts a territorial system of income taxation.

What is tax rebate. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Malaysia corporate income tax rate.

In the long term the malaysia corporate tax rate is projected to trend around 24 00 percent in 2021 according to our econometric models. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.